Life-changing

Confidence Boosting

Hair Transplant Surgeries

With GetHair, experience the perfect blend of advanced techniques and over 20 years of professional expertise in the hair transplant field.

Contact us and take the first step on your journey to a more youthful appearance, assured by our unmatched professional acumen

GetHair is rated 4.88 by 440+ independent reviewers online.

Your hair transplant journey: Simplified.

Expert Guidance Every Step of the Way: From Consultation to Post-Op Care, We're Here for You.

Free Consultation

Two-pages long, very detailed reports, all prepared by the senior hair surgeons.

Simply fill out the form to receive yours. Alternatively, book your appointment today and visit us in our offices.

95% Recommends

We have the highest recommendation rate in our industry. Our relationship with our patients never ends. Our post-op. follow-ups cover your entire recovery period.

3 Exceptional Doctors

Our internationally qualified and renowned surgeons have a combined experience of 50+ years in the hair transplants. ISHRS, ABHRS, IAHRS are some of their qualifications.

Clinics Based in Turkiye and US

We are one of the few if not the only provider with clinics located in multiple countries. Our clinics are based in Istanbul and Deerfield.

Watch Our Patient Videos

One of the best ways to find and evaluate a good hair clinic is by reading unbiased and independent hair transplant reviews.

Through reading our FUE hair transplant patient feedbacks, you can best gain a real insight into the life-changing procedures that have transformed the lives of thousands of patients.

Our Hair Transplant and Other Treatments in Turkiye

For those seeking the best services in hair restoration treatment, look no further. We provide our customers a life-changing solution, with hair transplant services provided by experienced doctors.

Each of our doctors have respected careers spanning over 20 years in the field and are able to offer an intrinsic understanding and insight of the hair transplant process. As well as understanding what our clients need, our doctors also pride themselves at GetHair for providing and delivery high-quality results with our hair transplant procedures.

Through selecting from a number of procedures that have been carefully considered, you can transform your look and your confidence with us, as we strive to provide our patients with the best care, meeting their expectations every step of the way.

If you are looking to have a hair transplant, GetHair can provide the solution for you, as you work closely with us throughout the process to ensure you are happy with the results and are familiar with the procedures.

Through reading our written reviews and independent testimonials, you can see for yourself the progress and satisfaction of previous clients, whose lives have been transformed with GetHair.

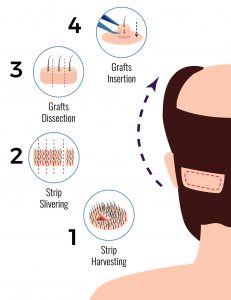

FUT (Follicular unit Transplantation)

- Trichophytic closure

- Still popular across the UK and US

Beard Transplant

- For a fuller, thicker looking beard

- FUE extraction

- Fixed cost

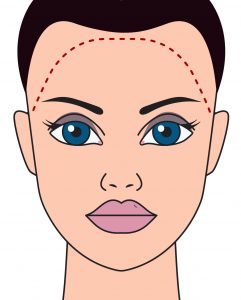

Female Hair Transplant

- FUE

- No shave FUE

Eyebrow Transplant

- FUE extraction

- Minimally invasive

- Shorter sessions

Moustache Transplant

- FUE extraction

- Minimally invasive

- Quick recovery

How to Have your hair transplant in Turkey?

Verify your suitability

Unfortunately not everyone is suitable for a hair transplant surgery. We need to collect 4-6 photos of you so our doctors can verify your suitability for the surgery. You can submit your photos using our free consultation form.

Decide On A Date

Once you receive the report and you are satisfied with its content, you can select a suitable date for the treatment. Please bear in mind we normally fully booked for 4-6 weeks. We advise our patients to book well in advance especially if they can only travel on certain dates due work/personal commitments.

Fly To Istanbul

You need to arrive in Istanbul the day before the surgery. Our driver will pick you up from the airport and take you to your hotel. Your surgery will be conducted next day in a hospital clinic with a fully qualified team of doctor and nurses. Our driver will take you back to your hotel after the surgery.

Surgery Time

The day after your surgery we will bring you back to our hospital for a post operative check up and your first aftercare session. You can to depart the day after the surgery, the earliest at 1pm.

Post Surgery Care

Our relationship does not end once you are back in your home country. We regularly check on you and will request your photos to share with our doctors. You are of course more than welcome to ask any questions you might have; your peace of mind is of utmost importance to us.

Meet Our Expert Hair Transplant Doctors in Turkey and US

As you know there are many hair transplant clinics in Turkey but there are only a handful who take huge pride in their work and are determined to provide medical services of the utmost quality to their patients.

Many clinics will may suggest their surgeon is one of the finest in the land but only very few can claim to be a member of both the ISHRS and the ABHRS.

Dr. Tayfun Oguzoglu

Born in 1965, Hair Surgeon Dr. Tayfun Oguzoglu is performing hair transplant operations in Istanbul since 1996.

- 20+ Years of Experience

- Over 11000 patients

- 5 International certificates

- Located in Istanbul, Turkey

Dr. Ilker Apaydın

Born in 1967, Plastic & Reconstructive Surgeon Dr. Ilker Apaydin is performing both FUT and FUE methods since 1998

- 20+ Years of Experience

- Over 9000 patients

- 4 International certificates

- Located in Istanbul, Turkey

Dr. Japhlet Aranas

- 5+ Years of Experience

- More than 1000 patients

- ABHRS and ISHRS member

- Located in Deerfield, IL, USA